If you’re lucky enough to have people you care about in your life, getting life insurance makes sense. Most of us don’t want to be remembered as ‘the person’ who left behind a financial mess for their children, wife, parents or even friends to have to deal with. Current events remind us that life is fragile.

Reasons people buy life insurance:

- to provide an income or lump sum payment to support your partner and any dependent children

- paying off an outstanding mortgage

- paying off other outstanding debts such as unsecured loans and credit card bills

- funeral expenses

- providing an inheritance

- to cover inheritance tax

If life were simple we could just buy one big plan to cover every eventuality but, regrettably, such a plan would cost a lot!

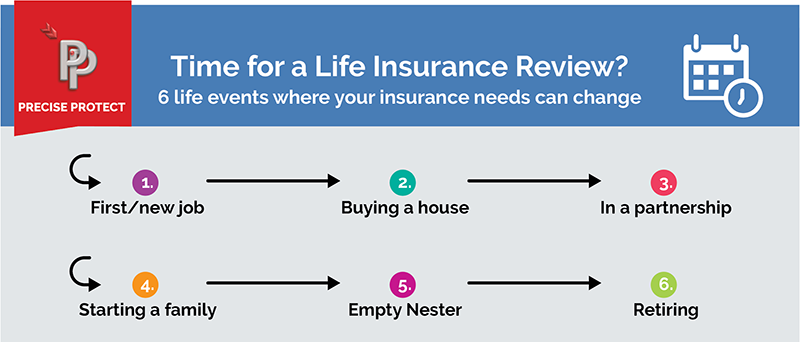

Instead, the insurance industry has developed products to meet our needs at different life events so that we don’t pay for benefits we don’t need. Examples of these products include Term Life Insurance, Decreasing Life Insurance and Whole-of-Life Insurance. Significant life stages where your insurance needs change are usually broken down into six areas:

Whatever stage of life you’re at, there’s a life insurance plan to suit your needs!

At this point we would like to add in a handy chart that highlights which products are most suited to each particular life stage but the number of ‘ifs’ and ‘buts’ would make it quite ‘un-handy’. Instead, we have described the most common types of insurance with an indication of when and why you might choose that type of insurance below.

The different types of life insurance

1. Level Term Insurance

Level Term insurance policies will pay out a fixed lump sum if you die within the policy term, and generally you will pay a fixed monthly or annual premium for the term.

Why you might buy Level Term Insurance

- If you are starting a family and want a your dependents to receive a fixed lump sum if you die. You might also consider Family Insurance as an additional insurance, or an option.

- If you are single but want to a) cover funeral expenses or other outstanding debts if you die and/or b) buy insurance while you are young and while premiums are cheaper with the expectation that you will start a family.

- If you are married you might consider a Level Term Insurance plan for each partner. A Joint Life Insurance Plan is also an option which may be more economical, but the payouts may not be sufficient for your needs.

2. Increasing-Term Insurance

Increasing life insurance policies pay out a sum that increases by a fixed amount or in line with inflation, maintaining its real value throughout the term. With this policy type your premiums will also increase over time.

Why you might buy Increasing Term Insurance

- If you are taking your insurance cover for a long period and wish to maintain the value of the payout in line with inflation. This might be important if your aim is to provide for dependents, or to cover inheritance tax.

3. Decreasing-Term Insurance / Mortgage Protection

Decreasing-Term Insurance, commonly known as Mortgage Protection Insurance, is designed to cover the outstanding value of your mortgage if you die during the term. As a result, the pay-out lump sum and premiums decrease through the term as the outstanding value of your mortgage decreases.

Why you might buy Decreasing Term Insurance

- This insurance type is most commonly used to cover an outstanding mortgage although it could be used to cover other decreasing expenses.

Handy Definitions

Term = the contract period for your insurance

Premium = the monthly or annual amount you pay for your insurance

Whichever life insurance you choose, you will purchase it for a ‘term’ – an agreed period of time – and pay a ‘premium’ – an agreed amount of money – on the understanding that if you pass away during the term, and all the conditions of the insurance are met, your heirs will get an agreed payout.

4. Joint Life Insurance

A Joint Life Insurance is designed to provide cover for two people – whether a couple or business partnership – where a lump sum payout is made to the surviving partner on the death of the first person. After that the policy ends and the remaining person is no longer covered should they die. This may or may not matter.

Why you might buy Joint Life Insurance

- As Joint life Insurance might cost less than purchasing two individual Term Life plans, this is a popular choice for newlyweds. However, if children are in the pipeline, then it might be wiser to buy two individual Term Life policies while young to take advantage of the lower prices, and on the assumption that if there are dependents and one parent dies, the remaining parent would still need cover.

5. Family Income Insurance

Family Income Protection Insurance ensures that should you die, your dependents receive a regular fixed income until the end of the term rather than a lump sum payout. Note that if you die a year before the end of the term, your dependents will only receive a year’s worth of payments. Generally premiums will remain the same for the period of the term but all the same, Family Income Insurance is usually considered a budget-friendly plan.

Why you might buy Family Income Insurance

- People often prefer to arrange for a regular income for their dependents rather than leave a lump sum which will require further financial planning to ensure it continues to provide until the dependents are financially independent.

6. Whole-of-Life Insurance

This insurance is an ongoing policy provide protection from the day the policy is taken out until your death. This insurance provides a guaranteed payout, however, it is often the more expensive option compared to other policies.

Why you might buy Whole-of-Life Insurance

- Because it is more expensive than other policies, it is usually only chosen when people want cover to be assured beyond the usual 20- or 30- year term, perhaps to cover inheritance tax, or perhaps to provide for a remaining partner or dependent.

‘Life insurance may cost less than you think’

‘Life insurance may cost less than you think’ is not an empty sales slogan. Your age, lifestyle, occupation and health will impact the cost of your plan but there are many providers and plans out there offering different types of insurance designed for specific situations and circumstances, and priced accordingly.

Just as you would not look at just one airline when booking a flight, you wouldn’t look at just one insurance provider. This is why working with an insurance broker, such as Precise Protect, who represents a large number of insurance providers is the surest way to get the best – in terms of price and benefits – product for your needs and situation!

— The need for life insurance has never been more clear —

Chat with an Adviser about your life insurance needs

Because there are different products best suited to different stages of your life, it is a good idea to get an insurance review when you come to a significant life event.

Please use the form below to request an experienced adviser call you to discuss your life insurance needs